I'VE BEEN WHERE YOU ARE

My own property journey started not with textbooks or checklists... I was a first-time investor, making big decisions and learning valuable lessons firsthand. That real-life insight, paired with deep industry knowledge, has shaped the practical strategies I now use to help others thrive. I know the difference the right plan and partner can make—because I've lived it.

MORE THAN A TITLE

In addition to being an NLP Practitioner, with a BA in Mass Communications, a Diploma in Direct Marketing, I'm also an active investor who has walked the same path as many of my clients. I've built a successful portfolio and I understand both the practical and emotional sides of the investment process.

PEOPLE FIRST, ALWAYS

I approach every client relationship with warmth, unwavering support, and a genuine interest in your success. I take the time to truly understand your unique situation, values and lifestyle goals, so I can design a strategy that works for you—not just on paper, but in real life. I'm not here for a transaction; I'm here for the long term. My commitment is to transparency, honesty and meaningful results. You deserve a partner who's dedicated to helping you build a future with confidence—and I'm that person.

Market Pulse

The Simple Holiday Checklist That Can Boost Your Borrowing Capacity

Let me tell you something I see every single December...

People switch off for the holidays - which is beautiful and needed.

But the savvy investors? They use this time quietly, calmly, behind the scenes, to set themselves up for their next move.

And with 2026 shaping up to be a year of opportunity (yes, despite the noise), the people who prepare now will be miles ahead of everyone who waits until February to "get back into it."

Here's how to use the holiday period to strengthen your position and step into the new year ready to invest with confidence.

1. Do a Quick Audit of Your Finances (No Spreadsheets Required)

Most people don't realise how much borrowing capacity they lose simply because their finances are messy, scattered, or out-of-date. Over the break, take 30 minutes to pull together:

What income is coming in (salary, overtime, rental income, bonuses)

What's going out (subscriptions, childcare, car repayments, Afterpay...the lot)

Your current loans

Your credit limits - not just the balance, the actual limit

You don't need to fix everything immediately. Just knowing where you stand puts you ahead of 90% of people.

Real Client Moment:

I worked with a client recently who thought they were "nowhere near ready." Turns out they were. They simply didn't realise how much disposable income they actually had because it wasn't written down anywhere. Once we cleaned it up, they were able to move on a dual-living build and are now well ahead of schedule for their long-term plan.

2. Reduce or Cancel Unused Credit Cards

What income is coming in (salary, overtime, rental income, bonuses)

What's going out (subscriptions, childcare, car repayments, Afterpay...the lot)

Your current loans

Your credit limits - not just the balance, the actual limit

You don't need to fix everything immediately. Just knowing where you stand puts you ahead of 90% of people.

3. Consolidate Personal Loans (Outside Your Mortgage)

If you've got a car loan, personal loan, or a few lingering debts floating around, consolidating can:

Reduce your monthly repayments

Simplify your finances

Improve your servicing with lenders

Many lenders look more favourably at one well-managed loan than multiple scattered ones. It's not about "being perfect" - it's about being finance-ready.

4. Decide What You Want Your Money to Do in 2026

This is one of the most important things I get clients to do:

Set the intention. Are you aiming for:

Your first investment property?

A rentvesting move?

A duplex or dual-living build to accelerate your cashflow?

A long-term growth play?

If you don't know where you're heading, you can't structure your finance at the right level. And lenders absolutely care about structure.

Even a simple conversation over the break - "What do we want the next 5-10 years to look like?," helps your make smarter decisions in January, not rushed ones in June.

5. Gather Your Documents Now Instead of in a Panic Later

Every single year, without fail, someone messages me: "Maria, the bank wants all this paperwork and I can't find anything!"

You can save yourself the stress by collecting:

Last 3-6 months of payslips and bank statements

Tax returns

Super statements

Rental statements (if applicable)

ID documents

Having everything ready means when the right property pops up in 2026, you're not scrambling. You're already prepped!

6. Book Your Finance Review Early

January and February are traditionally very busy for brokers and lenders.

If you get your review done early even if you're not buying until later in the year, you'll:

Know exactly what you can borrow

Understand what needs to be improved

Have time to implement improvements

Move quickly when an opportunity arises.

Borrowing capacity is tightening for many Aussies. Those who prepare are the ones who still get to move.

The Simple Holiday Checklist That Can Boost Your Borrowing Capacity

Let me tell you something I see every single December...

People switch off for the holidays - which is beautiful and needed.

But the savvy investors? They use this time quietly, calmly, behind the scenes, to set themselves up for their next move.

And with 2026 shaping up to be a year of opportunity (yes, despite the noise), the people who prepare now will be miles ahead of everyone who waits until February to "get back into it."

Here's how to use the holiday period to strengthen your position and step into the new year ready to invest with confidence.

1. Do a Quick Audit of Your Finances (No Spreadsheets Required)

Most people don't realise how much borrowing capacity they lose simply because their finances are messy, scattered, or out-of-date. Over the break, take 30 minutes to pull together:

What income is coming in (salary, overtime, rental income, bonuses)

What's going out (subscriptions, childcare, car repayments, Afterpay...the lot)

Your current loans

Your credit limits - not just the balance, the actual limit

You don't need to fix everything immediately. Just knowing where you stand puts you ahead of 90% of people.

Real Client Moment:

I worked with a client recently who thought they were "nowhere near ready." Turns out they were. They simply didn't realise how much disposable income they actually had because it wasn't written down anywhere. Once we cleaned it up, they were able to move on a dual-living build and are now well ahead of schedule for their long-term plan.

2. Reduce or Cancel Unused Credit Cards

What income is coming in (salary, overtime, rental income, bonuses)

What's going out (subscriptions, childcare, car repayments, Afterpay...the lot)

Your current loans

Your credit limits - not just the balance, the actual limit

You don't need to fix everything immediately. Just knowing where you stand puts you ahead of 90% of people.

3. Consolidate Personal Loans (Outside Your Mortgage)

If you've got a car loan, personal loan, or a few lingering debts floating around, consolidating can:

Reduce your monthly repayments

Simplify your finances

Improve your servicing with lenders

Many lenders look more favourably at one well-managed loan than multiple scattered ones. It's not about "being perfect" - it's about being finance-ready.

4. Decide What You Want Your Money to Do in 2026

This is one of the most important things I get clients to do:

Set the intention. Are you aiming for:

Your first investment property?

A rentvesting move?

A duplex or dual-living build to accelerate your cashflow?

A long-term growth play?

If you don't know where you're heading, you can't structure your finance at the right level. And lenders absolutely care about structure.

Even a simple conversation over the break - "What do we want the next 5-10 years to look like?," helps your make smarter decisions in January, not rushed ones in June.

5. Gather Your Documents Now Instead of in a Panic Later

Every single year, without fail, someone messages me: "Maria, the bank wants all this paperwork and I can't find anything!"

You can save yourself the stress by collecting:

Last 3-6 months of payslips and bank statements

Tax returns

Super statements

Rental statements (if applicable)

ID documents

Having everything ready means when the right property pops up in 2026, you're not scrambling. You're already prepped!

6. Book Your Finance Review Early

January and February are traditionally very busy for brokers and lenders.

If you get your review done early even if you're not buying until later in the year, you'll:

Know exactly what you can borrow

Understand what needs to be improved

Have time to implement improvements

Move quickly when an opportunity arises.

Borrowing capacity is tightening for many Aussies. Those who prepare are the ones who still get to move.

Why This Matters for 2026

With interest rates stabilising and population growth pushing demand, 2026 will reward investors who enter the market with:

Clean finances

A strong borrowing position

A clear strategy

I see it year after year: Preparation is the difference between watching the market and buying in it.

Your Holiday Takeaway

You don't need to overhaul your entire life over the break.

Just focus on:

Tidying up your finances

Reducing unnecessary debt

Gathering your documents

Setting your strategy

Putting yourself in a position lenders look at favourably.

Do that, and you'll glide into 2026 ready to make smart moves instead of reactive ones.

If you want help preparing your 2026 strategy...

This is exactly what I guide clients through - step-by-step, without overwhelm. If you want clarity heading into the new year, book a quick chat with me. We'll map out where you are now, where you want to go, and the smartest way to get there.

Market Pulse

The Simple Holiday Checklist That Can Boost Your Borrowing Capacity

Let me tell you something I see every single December...

People switch off for the holidays - which is beautiful and needed.

But the savvy investors? They use this time quietly, calmly, behind the scenes, to set themselves up for their next move.

And with 2026 shaping up to be a year of opportunity (yes, despite the noise), the people who prepare now will be miles ahead of everyone who waits until February to "get back into it."

Here's how to use the holiday period to strengthen your position and step into the new year ready to invest with confidence.

1. Do a Quick Audit of Your Finances (No Spreadsheets Required)

Most people don't realise how much borrowing capacity they lose simply because their finances are messy, scattered, or out-of-date. Over the break, take 30 minutes to pull together:

What income is coming in (salary, overtime, rental income, bonuses)

What's going out (subscriptions, childcare, car repayments, Afterpay...the lot)

Your current loans

Your credit limits - not just the balance, the actual limit

You don't need to fix everything immediately. Just knowing where you stand puts you ahead of 90% of people.

Real Client Moment:

I worked with a client recently who thought they were "nowhere near ready." Turns out they were. They simply didn't realise how much disposable income they actually had because it wasn't written down anywhere. Once we cleaned it up, they were able to move on a dual-living build and are now well ahead of schedule for their long-term plan.

2. Reduce or Cancel Unused Credit Cards

What income is coming in (salary, overtime, rental income, bonuses)

What's going out (subscriptions, childcare, car repayments, Afterpay...the lot)

Your current loans

Your credit limits - not just the balance, the actual limit

You don't need to fix everything immediately. Just knowing where you stand puts you ahead of 90% of people.

3. Consolidate Personal Loans (Outside Your Mortgage)

If you've got a car loan, personal loan, or a few lingering debts floating around, consolidating can:

Reduce your monthly repayments

Simplify your finances

Improve your servicing with lenders

Many lenders look more favourably at one well-managed loan than multiple scattered ones. It's not about "being perfect" - it's about being finance-ready.

4. Decide What You Want Your Money to Do in 2026

This is one of the most important things I get clients to do:

Set the intention. Are you aiming for:

Your first investment property?

A rentvesting move?

A duplex or dual-living build to accelerate your cashflow?

A long-term growth play?

If you don't know where you're heading, you can't structure your finance at the right level. And lenders absolutely care about structure.

Even a simple conversation over the break - "What do we want the next 5-10 years to look like?," helps your make smarter decisions in January, not rushed ones in June.

5. Gather Your Documents Now Instead of in a Panic Later

Every single year, without fail, someone messages me: "Maria, the bank wants all this paperwork and I can't find anything!"

You can save yourself the stress by collecting:

Last 3-6 months of payslips and bank statements

Tax returns

Super statements

Rental statements (if applicable)

ID documents

Having everything ready means when the right property pops up in 2026, you're not scrambling. You're already prepped!

6. Book Your Finance Review Early

January and February are traditionally very busy for brokers and lenders.

If you get your review done early even if you're not buying until later in the year, you'll:

Know exactly what you can borrow

Understand what needs to be improved

Have time to implement improvements

Move quickly when an opportunity arises.

Borrowing capacity is tightening for many Aussies. Those who prepare are the ones who still get to move.

Why This Matters for 2026

With interest rates stabilising and population growth pushing demand, 2026 will reward investors who enter the market with:

Clean finances

A strong borrowing position

A clear strategy

I see it year after year: Preparation is the difference between watching the market and buying in it.

Risks and Things to Keep In Mind

Investing in property is not without risks. Market fluctuations, unexpected vacancies and maintenance expenses can impact returns. You may need to cover shortfalls from other income sources, so it's important to maintain a financial buffer.

Always seek professional advice to ensure your property investment strategy aligns with your long-term goals and risk tolerance.

If you are considering leveraging your home equity and investing in property to help pay off your home sooner, it is advisable to consult your finance team or property investment specialists.

With the right guidance and strategy, you may be on the path to mortgage freedom faster than you think.

Maria's Minute

Click the video below to watch Maria's Minute.

I warmly wish you a Merry Christmas and more success in the New Year ahead!

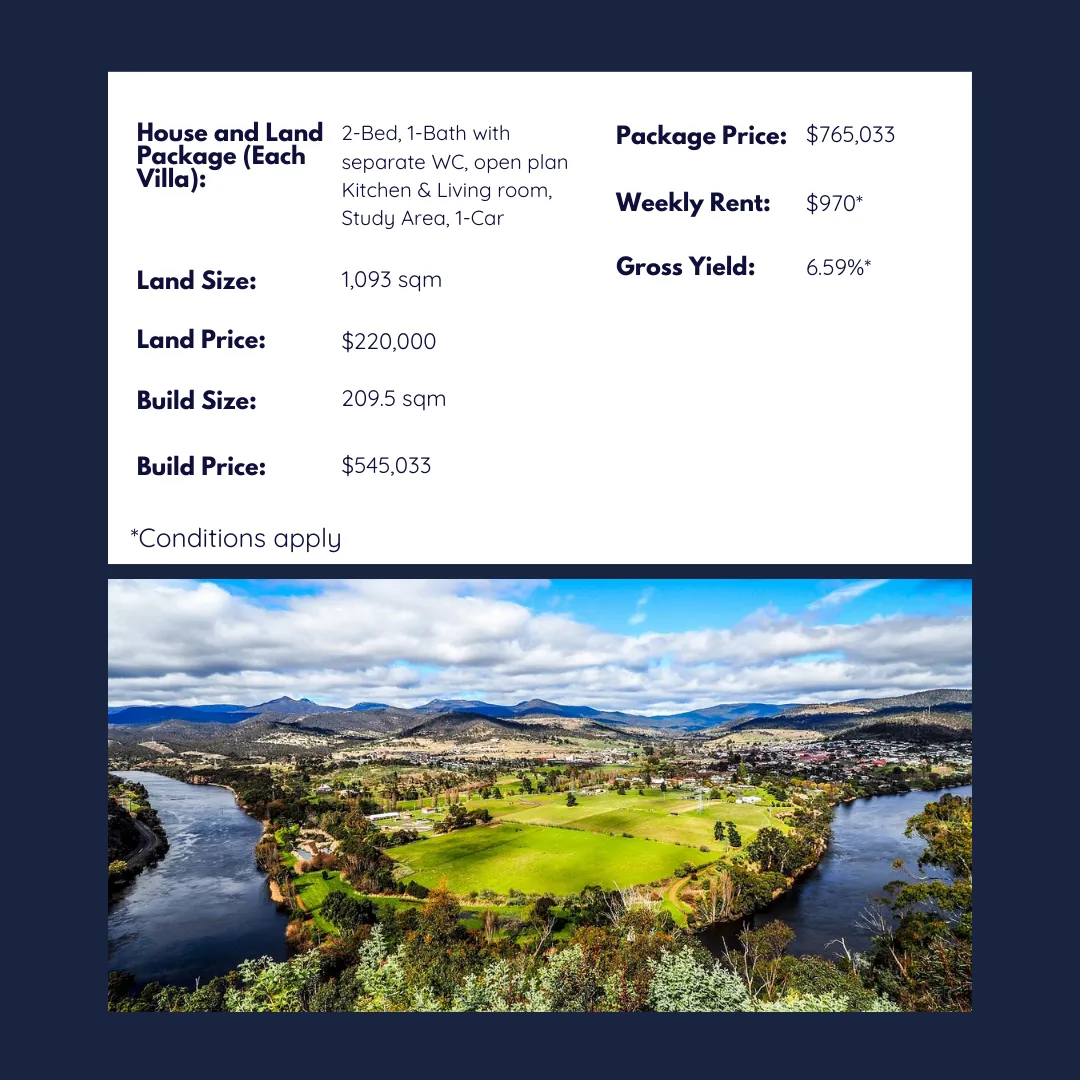

Property Spotlight

Property Spotlight

Solid Rental Yield, Double Income

$100M Lyell Highway duplication (Granton-New Norfolk)

$250M Bryn Estyn Water Treatment Plant upgrade

House price annual growth averaging to +9.5%

$100M Sunbury South Town Centre - 25,000 sqm to include retail, health services, co-working spaces, outdoor dining, and green areas

Major private developments including: The Mills - drives residential growth and services; $75M Noble Life Retirement Resort (186 homes) underway, generating jobs and diversifying housing stock.

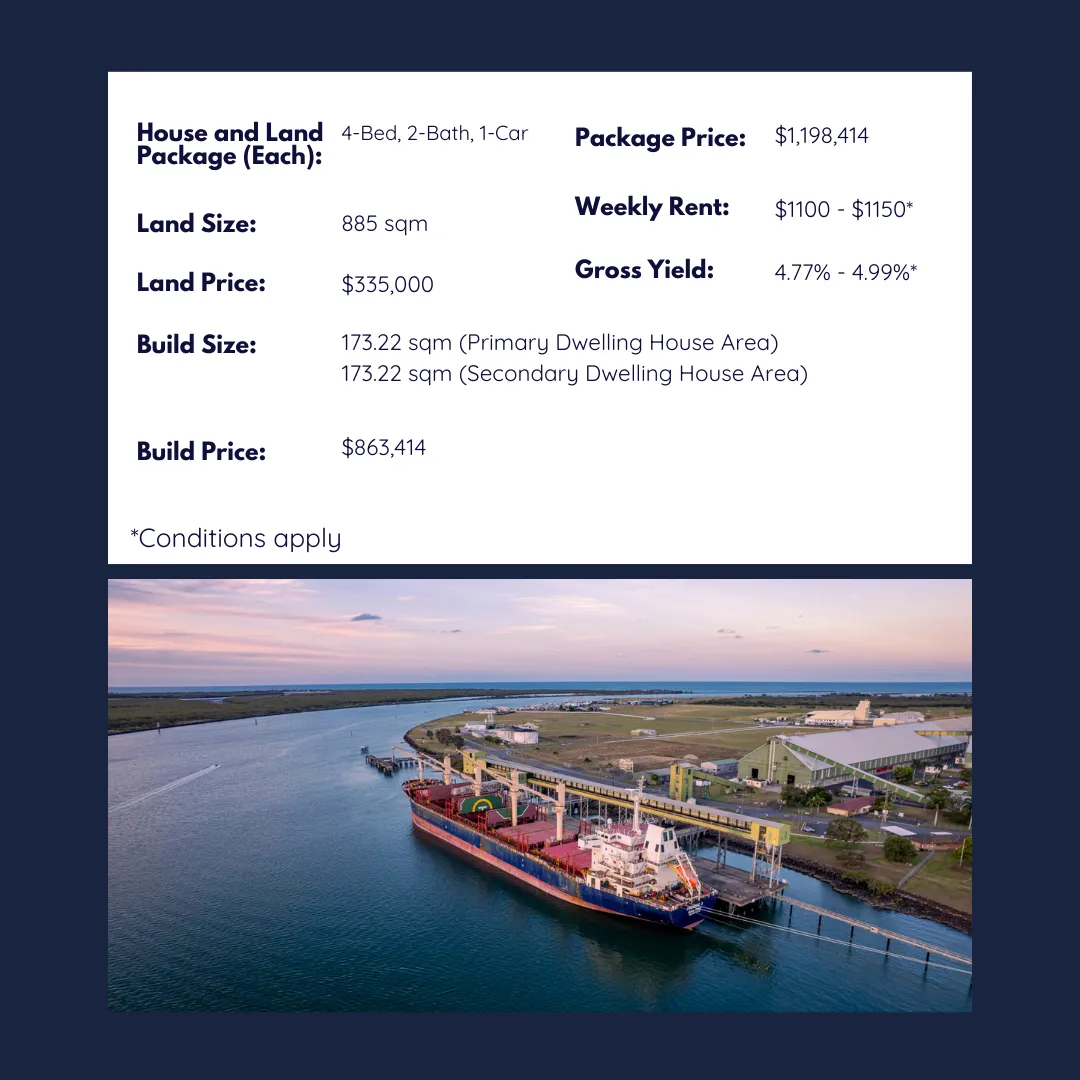

Dual Property,

Coastal Lifestyle

Marine access upgrade: A $3 million state-funded upgrade to the Walkers Point boat ramp is planned, improving marine access and recreation infrastructure, with works expected through 2025

Coastal asset protection investment: funded sand nourishment + seawall and buffers protect key public assets (supports long-term desirability)

Proximity to Bundaberg services + airport: access to regional employment and healthcare while retaining a quiet beach setting

Woodgate Beach Park North amenities upgrade - Amenities refurbishment delivered under Council's Parks, Sports & Natural Areas Capital Works Program 2022-2023

Solid Rental Yield, Double Income

$100M Lyell Highway duplication (Granton-New Norfolk)

$250M Bryn Estyn Water Treatment Plant upgrade

House price annual growth averaging to +9.5%

Stable population growth and strong demographic mix of homeowners and families

Strong rental yields (5%) combined with rising rents and low vacancies

Major private developments including: The Mills - drives residential growth and services; $75M Noble Life Retirement Resort (186 homes) underway, generating jobs and diversifying housing stock.

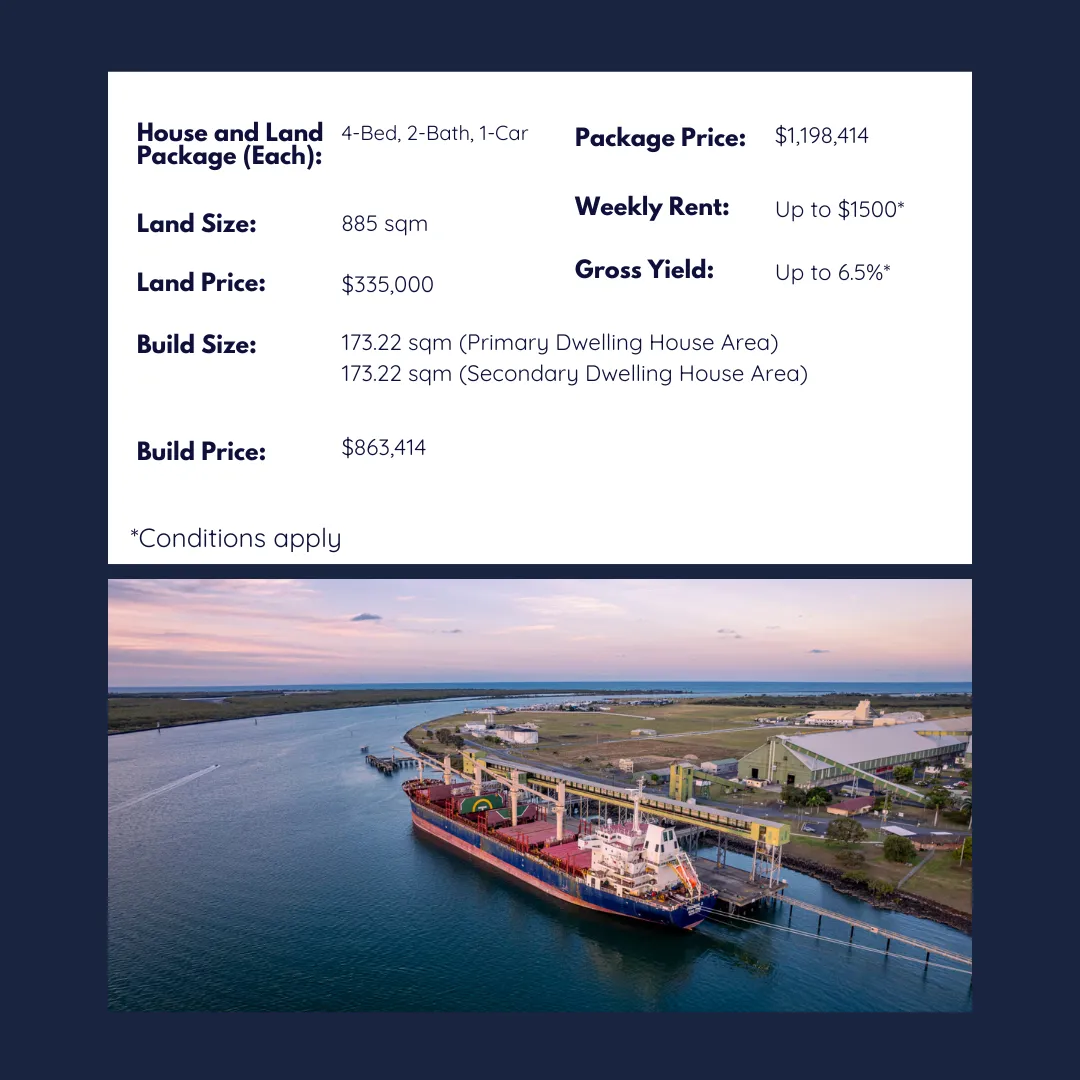

Dual Property, Coastal Lifestyle

$300,000 equity uplift

$1.2B new Bundaberg Hospital - 1,000 new jobs and completion 2027

Burnett Heads Harbour - $250M Project for retail, restaurants and cafes

$2.38B Bruce Hwy Upgrades

$47M Port of Bundaberg - 24,000 jobs by 2035

Bundaberg Train Station - multi-million dollar upgrade

Super Brewery $152.4M - 600 new and ongoing jobs

Civil & Cultural Precinct $45M - 100 new jobs and ongoing development

Copyright 2025 . All rights reserved