I'VE BEEN WHERE YOU ARE

My own property journey started not with textbooks or checklists... I was a first-time investor, making big decisions and learning valuable lessons firsthand. That real-life insight, paired with deep industry knowledge, has shaped the practical strategies I now use to help others thrive. I know the difference the right plan and partner can make—because I've lived it.

MORE THAN A TITLE

In addition to being an NLP Practitioner, with a BA in Mass Communications, a Diploma in Direct Marketing, I'm also an active investor who has walked the same path as many of my clients. I've built a successful portfolio and I understand both the practical and emotional sides of the investment process.

PEOPLE FIRST, ALWAYS

I approach every client relationship with warmth, unwavering support, and a genuine interest in your success. I take the time to truly understand your unique situation, values and lifestyle goals, so I can design a strategy that works for you—not just on paper, but in real life. I'm not here for a transaction; I'm here for the long term. My commitment is to transparency, honesty and meaningful results. You deserve a partner who's dedicated to helping you build a future with confidence—and I'm that person.

Market Pulse

Over the past 5 to 10 years, Australian homeowners have seen remarkable growth in residential property prices. According to CoreLogic data, median dwelling values in major cities such as Sydney and Melbourne have increased by approximately 50% to 70% since 2015, even though there are reports about property values in Melbourne and Sydney not increasing.

This growth has created significant equity for many Australians, often amounting to hundreds of thousands of dollars.

For those who oen their home, or have a small mortgage compared to the value, this equity may be a valuable resource to help accelerate mortgage repayment by investing in additional property. Many Australians may be able to leverage this equity to build a property portfolio that not only has the potential to grow their financial position but also assist in paying off their home loan sooner.

Ultimately, the most important factor is selecting the right property with a suitable yield and growth potential.

Why leveraging your home equity may matter more than ever

The equity built in your home may represent more than just an increase in property value. It can be a financial tool that might unlock investment opportunities. Depending on your lender's policies and your financial situation, you may be able to access this equity through a line of credit or a home equity loan to fund the purchase of an investment property.

This approach could allow you to invest without needing a large deposit from your savings. Simply making extra repayments on your home loan may not always be the most effective way to reduce your mortgage term. Investing in property may generate capital growth and potential tax benefits that could then be applied towards paying down your home loan faster.

The key is to ensure the property has strong growth potential or is located in an area with rising demand.

Selecting the right property is crucial

A poorly chosen investment may lead to ongoing losses and financial strain.

How to select the right property to accelerate your mortgage payoff

Focus on growth corridors - Consider suburbs or regions with strong infrastructure projects, population growth and employment opportunities. Areas undergoing developement or gentrification may offer better capital growth over time.

Consider property type and condition - Newer properties or well maintained homes may attract reliable tenants and reduce unexpected maintenance costs. Units or townhouses in popular locations can also offer good entry points for investors.

Research market trends and seek expert advice - Use data from sources such as the Australian Bureau of Statistics (ABS), CoreLogic and local real estate experts to inform your choices. Our finance specialists and property networks may help tailor your strategy to your situation.

Using investment to pay off your home sooner

Benefits beyond faster mortgage repayment

Building a property portfolio may help you accumulate assets that can be used to fund or part fund your retirement or other financial goals.

Diversification - Owning multiple properties can spread your risk and income sources.

Tax efficiency - Strategic use of tax deductions and depreciation may improve your cash flow.

Financial security - Paying off your home sooner may reduce interest costs and increase your equity buffer.

Once you own an investment property, you may be able to use rental income and any tax benefits to make additional repayments on your home loan. Any tax deductions may improve your overall cash flow position.

Over time, capital growth capital growth on your investment property might provide a lump sum gain when you sell that could be applied to reduce your home mortgage.

For example, if a homeowner in Brisbane purchased an investment property in a growth suburb several years ago by leveraging their home equity to do so, the capital growth of around 40% combined with rising rental income would have allowed them to make extra repayments on their home loan.

Always seek professional advice to ensure your property investment strategy aligns with your long-term goals and risk tolerance.

If you are considering leveraging your home equity and investing in property to help pay off your home sooner, book a chat with me below. With the right guidance and strategy, you may be on the path to mortgage freedom faster than you think.

Market Pulse

Over the past 5 to 10 years, Australian homeowners have seen remarkable growth in residential property prices. According to CoreLogic data, median dwelling values in major cities such as Sydney and Melbourne have increased by approximately 50% to 70% since 2015, even though there are reports about property values in Melbourne and Sydney not increasing.

This growth has created significant equity for many Australians, often amounting to hundreds of thousands of dollars.

For those who oen their home, or have a small mortgage compared to the value, this equity may be a valuable resource to help accelerate mortgage repayment by investing in additional property. Many Australians may be able to leverage this equity to build a property portfolio that not only has the potential to grow their financial position but also assist in paying off their home loan sooner.

Ultimately, the most important factor is selecting the right property with a suitable yield and growth potential.

Why Leveraging Your Home Equity May Matter More Than Ever

The equity built in your home may represent more than just an increase in property value. It can be a financial tool that might unlock investment opportunities. Depending on your lender's policies and your financial situation, you may be able to access this equity through a line of credit or a home equity loan to fund the purchase of an investment property.

This approach could allow you to invest without needing a large deposit from your savings. Simply making extra repayments on your home loan may not always be the most effective way to reduce your mortgage term. Investing in property may generate capital growth and potential tax benefits that could then be applied towards paying down your home loan faster.

The key is to ensure the property has strong growth potential or is located in an area with rising demand.

SELECTING THE RIGHT PROPERTY IS CRUCIAL

A poorly chosen investment may lead to ongoing losses and financial strain.

How to Select the Right Property To Accelerate Your Mortgage Payoff

Focus on growth corridors - Consider suburbs or regions with strong infrastructure projects, population growth and employment opportunities. Areas undergoing developement or gentrification may offer better capital growth over time.

Consider property type and condition - Newer properties or well maintained homes may attract reliable tenants and reduce unexpected maintenance costs. Units or townhouses in popular locations can also offer good entry points for investors.

Research market trends and seek expert advice - Use data from sources such as the Australian Bureau of Statistics (ABS), CoreLogic and local real estate experts to inform your choices. Our finance specialists and property networks may help tailor your strategy to your situation.

Using Investment Property To Pay Off Your Home Sooner

Once you own an investment property, you may be able to use rental income and any tax benefits to make additional repayments on your home loan. Any tax deductions may improve your overall cash flow position.

Over time, capital growth capital growth on your investment property might provide a lump sum gain when you sell that could be applied to reduce your home mortgage.

For example, if a homeowner in Brisbane purchased an investment property in a growth suburb several years ago by leveraging their home equity to do so, the capital growth of around 40% combined with rising rental income would have allowed them to make extra repayments on their home loan.

As a result, they should be able to reduce their mortgage term by several years and improve their overall financial position.

Of course, individual results will vary depending on factors such as property performance, location, supply and demand and financing arrangements.

Benefits Beyond Faster Mortgage Repayment

Building a property portfolio may help you accumulate assets that can be used to fund or part fund your retirement or other financial goals.

Diversification - Owning multiple properties can spread your risk and income sources.

Tax efficiency - Strategic use of tax deductions and depreciation may improve your cash flow.

Financial security - Paying off your home sooner may reduce interest costs and increase your equity buffer.

Risks and Things to Keep In Mind

Investing in property is not without risks. Market fluctuations, unexpected vacancies and maintenance expenses can impact returns. You may need to cover shortfalls from other income sources, so it's important to maintain a financial buffer.

Always seek professional advice to ensure your property investment strategy aligns with your long-term goals and risk tolerance.

If you are considering leveraging your home equity and investing in property to help pay off your home sooner, it is advisable to consult your finance team or property investment specialists.

With the right guidance and strategy, you may be on the path to mortgage freedom faster than you think.

Maria's Minute

Click the video below to watch Maria's Minute.

Everyone wants the next interest rate cut...but what's the REAL cost?

Watch the video below and let's break down the real numbers!

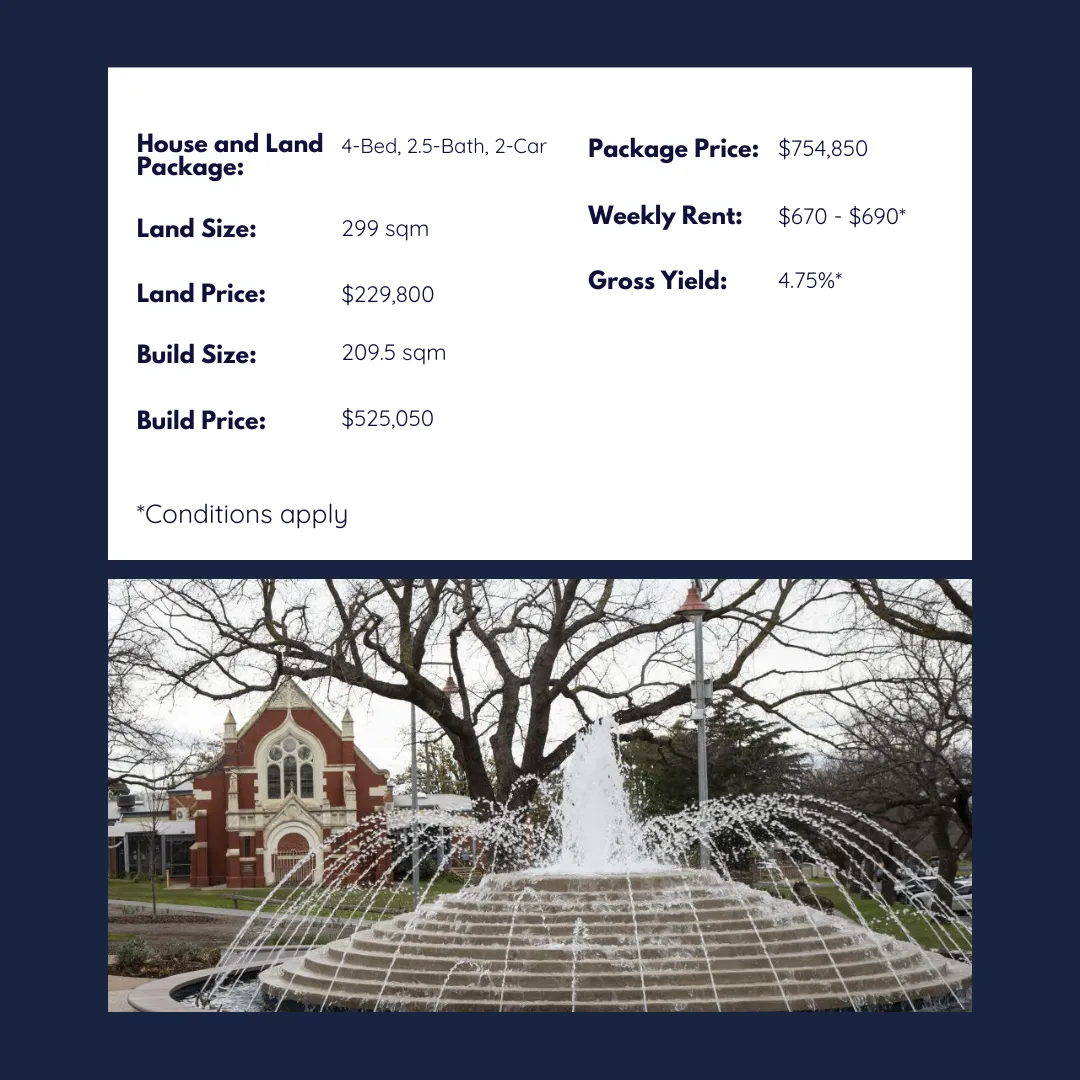

Property Spotlight

Property Spotlight

Fast-growing, Family Oriented Suburb

Sunbury Line upgrade completed $1B

Population forecast growth of 137% by 2046

$506B Metro Tunnel Project due for completion 2025

$100M Sunbury South Town Centre - 25,000 sqm to include retail, health services, co-working spaces, outdoor dining, and green areas

New $6M SES facility is planned

Sunbury Road upgrade finished in 2024 - Extra lanes, a new bridge, and bike paths added

Current capital growth rate of 5.8% and climbing

Fast-growing, Family Oriented Suburb

Sunbury Line upgrade completed $1B

Population forecast growth of 137% by 2046

$506B Metro Tunnel Project due for completion 2025

$100M Sunbury South Town Centre - 25,000 sqm to include retail, health services, co-working spaces, outdoor dining, and green areas

New $6M SES facility is planned

Sunbury Road upgrade finished in 2024 - Extra lanes, a new bridge, and bike paths added

Current capital growth rate of 5.8% and climbing

Copyright 2025 . All rights reserved